Traders and investors have for years been looking for an edge in the markets. And rightly so, since trading the markets is a zero-sum venture. For there to be winners, there has to be losers. Frankly speaking, as a trader you are not going head-to-head with the market itself, you are going head-to-head with other traders. Do you have what it takes to be on the correct side of the trade more times than not?

There are a lot of factors to becoming a successful trader. You need to develop the right mindset (psychology) and you need to have good risk and money management disciplines. But the bottom line is that in order to profit you must buy low and sell high. In order to do that, you need to develop skills in market timing. Without good market timing skills, you could find yourself buying high and selling low. Clearly, that is not the most desired position to be in with your hard earned money.

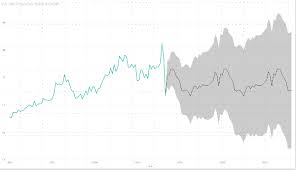

When it comes to market timing, I have found that nothing gives a trader a bigger edge than timing the markets based on ‘dynamic cycles’. The term ‘dynamic’ in relation to ‘cycles’ in this context refers to reality that price action tends to make tops and bottoms at varying intervals as opposed to fixed intervals. Together, the term ‘dynamic’ associated with ‘cycles’ may sound like an oxy-moron since the pure definition of a ‘cycle’ is that of something repeating itself as before. For example, each day is a 24-hour ‘cycle’. This is a fixed interval and clearly a ‘cycle’ that we are all familiar with. If each day was not based on a fixed 24-hour cycle, but instead varied from day to day where today is 24-hours, tomorrow perhaps 15-hours and so-forth, that would be a good comparison of what a ‘dynamic cycle’ is. In other words, we would still have one day after another, but each would be of a different ‘time’ length (dynamic).

If you have been studying price charts for some time, it is likely that you have seen times when the market would make a top or bottom at almost a fixed interval of time in days, weeks, etc. Most cycle traders look for these to appear in price action in order to anticipate the next top or bottom in the market. Sometimes you get it, sometimes you do not. The thing about fixed cycles is that often as soon as you find one it goes away. If you enter a trade in anticipation that it will continue, you often will incur losses. Obviously, there would be no market to trade if it was going to be that easy. How long would it take for everyone to find out that market xyz makes a top or bottom every 7 days or 4 weeks, etc? Not long.

In the real world, the price patterns we see on our charts are the result of more than one cycle at work at any given time. Each cycle is of a different cycle-length (frequency) and magnitude (amplitude). With multiple cycles at work at one time, each affecting the market differently than the other, what you end up with is the patterns we find on our price charts that reflect the characteristics of all these cycles combined. Depending on which cycle is currently in the role as the ‘dominant’ cycle for any given market, you will see its influence for however long that cycle is dominant, although not perfectly shaped because of the influence of the currently ‘weaker’ co-cycles also involved.

You may not have realized this before but you have likely seen evidence of this many times when studying your charts with various indicators. For example, perhaps you use the MACD or the Stochastic indicator. Have you noticed that while the chart appears quite erratic or distorted at times that your oscillator indicator is showing you a nice clear cycle of moving from overbought to oversold and back again? I’m sure you have. That is what these particular indicators are designed to do, help you find the ‘cyclic’ pattern at work. Perhaps you also noticed that the time between the overbought swings to the oversold swings of the oscillator cycle pattern do not occur at even time intervals. You are looking at ‘dynamic cycles’ at work, the culmination of more than one fixed-cycle affecting the market at any given time.

While such indicators are useful at times, they also have a tendency to become useless when the market is in a strong trend. You may have noticed that they will become ‘pegged’ to the overbought or oversold zone and can stay there for a long period of time. Meanwhile, the market is still producing pullbacks along that strong bullish or bearish trend that you could be capitalizing on. Naturally then, especially during these periods, it would help to have some evidence that such a correction is likely to occur however small.

During the early 1990’s I did extensive research into how to exploit these cycles. The purpose was to improve timing trade entries in order to keep the risk exposure low while giving the trade more profit potential. Let’s face the facts that the closer you can buy off the bottom the less you have to risk and the more you can capture from your trade.

Beginning Work-Outs to Look Great in Your Swimming Suit

Beginning Work-Outs to Look Great in Your Swimming Suit  The Easy Way to Find Stylish Plus Size Swimming Suits

The Easy Way to Find Stylish Plus Size Swimming Suits  Can You Really Make Money Betting on Sports?

Can You Really Make Money Betting on Sports?  The Mechanism of Sports Sponsorships

The Mechanism of Sports Sponsorships